Weichai exceeds 650,000 units, Yunnei and Yuchai compete for second place, Foton Cummins and Dongfeng show impressive growth. Diesel engine data for the first 8 months.

Release time:

2020-09-14

In August, commercial vehicle production and sales continued to see positive year-on-year growth, but the growth rate narrowed significantly. The truck market experienced a general decline, with the exception of a slight month-on-month increase in medium-duty trucks. Although bus market sales saw positive month-on-month growth and a narrower year-on-year decline, the sub-segments once again faced a "total wipeout" in August.

In August, commercial vehicle production and sales continued to see positive year-on-year growth, but the growth rate significantly narrowed. The truck market experienced a decline except for a slight month-on-month increase in medium-duty trucks. Although the bus market saw positive month-on-month sales growth and a narrower year-on-year decline, its segmented markets once again faced a 'total wipeout' in August.

Overall, as the second half of the year began, the commercial vehicle market is 'cooling down'. After two consecutive months of narrowing in July and August, the high year-on-year growth rate of 63% in June is now 42%. So, what changes have occurred in the diesel engine power market and the national internal combustion engine market, which are closely related to the commercial vehicle market?

Below, please see the report from Commercial Vehicle Online (Diyi Shangyongche Wang).

In August, 4.17 million internal combustion engines were sold, a year-on-year increase of 11.9%! Diesel engine growth narrowed to 38.7%!

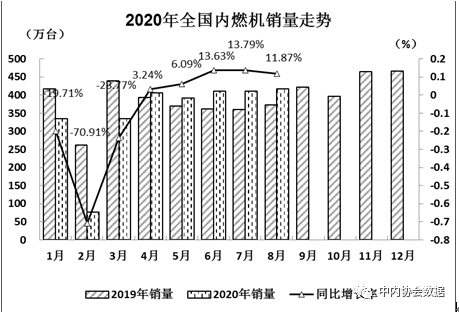

According to the 'China Internal Combustion Engine Industry Sales Monthly Report' from the China Internal Combustion Engine Industry Association, at comparable prices, national internal combustion engine sales in August this year reached 4.1711 million units, a month-on-month increase of 1.71% and a year-on-year increase of 11.87%; cumulative sales from January to August were 27.8872 million units, a year-on-year decrease of 6.38%, narrowing the decline by 2.62 percentage points compared to the previous month. Starting from April this year, the internal combustion engine market has achieved five consecutive months of year-on-year growth, with the growth rate expanding month by month in the first four months, and narrowing by nearly 2 percentage points in August.

Among the two major categories of gasoline and diesel, diesel engine sales in August were 506,200 units, a month-on-month decrease of 6.22% and a year-on-year increase of 38.71% (in comparison, the year-on-year growth of diesel engines also narrowed in August); from January to August this year, cumulative diesel engine sales were 3.9985 million units, accounting for 14.33% of the total internal combustion engine volume. Gasoline engine sales in August were 3.6636 million units, a year-on-year increase of 8.92%; cumulative sales from January to August were 23.8660 million units, with their monthly year-on-year growth rate narrowing earlier than diesel engines, already in July.

Commercial vehicle internal combustion engines, which have received significant industry attention, saw sales of 320,900 units in August, a month-on-month decrease of 7.64%, with the year-on-year growth rate narrowing from 85% in July to 53.17%; cumulative sales from January to August were 2.4523 million units, with a year-on-year growth rate of 23.06%. It is noteworthy that among all segmented markets by application, commercial vehicle internal combustion engines consistently had the highest year-on-year growth, both monthly and in cumulative sales, serving as the biggest driver for the sustained positive growth of internal combustion engines.

From January to August, multi-cylinder diesel engine sales reached 3.384 million units; Weichai exceeded 650,000 units, Yunnei saw a significant year-on-year increase of 52%!

Diesel internal combustion engines are divided into single-cylinder and multi-cylinder types. Single-cylinder diesel engines are mainly used in agricultural machinery; their sales in August once again achieved positive year-on-year growth, and the cumulative decline from January to August narrowed to 5.84%.

Multi-cylinder diesel engines are primarily used in the commercial vehicle market. With the commercial vehicle market experiencing five consecutive months of rapid growth, multi-cylinder diesel engines also showed significant increases for five consecutive months. In August, multi-cylinder diesel engine enterprises sold a total of 427,400 units, a month-on-month decrease of 7.50% and a year-on-year increase of 42.79% (the year-on-year growth rate also significantly narrowed in August, 26.51 percentage points lower than July); cumulative sales from January to August reached 3.3838 million units, a year-on-year increase of 18.24%.

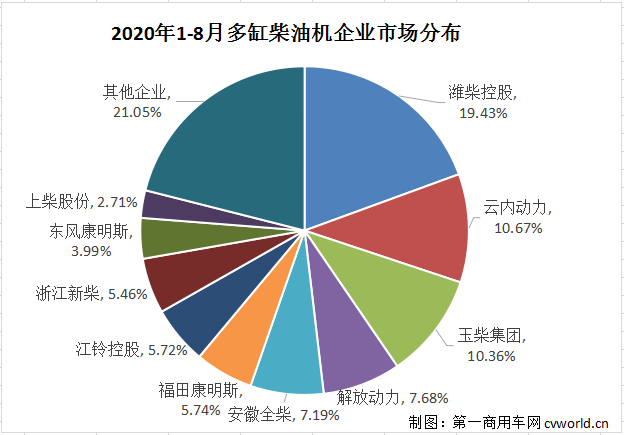

From January to August this year, the top ten enterprises in cumulative sales of multi-cylinder diesel engines were Weichai, Yunnei Power, Yuchai, FAW Jiefang Power, Anhui Quanchai, Foton Cummins, Jiangling Motors Corporation (JMC), Zhejiang Xinchai, Dongfeng Cummins, and SAIC Diesel Engine (Shangchai Power). Starting from April, FAW Jiefang Xichai and Dachai merged their financial statements into FAW Jiefang Power, consistently ranking fourth on this list. Based on market share calculations, Weichai Holding's multi-cylinder diesel engine sales from January to August were approximately 657,500 units.

The cumulative sales of the top ten multi-cylinder diesel engine enterprises were approximately 2.67 million units, accounting for 78.95% of total sales. Compared to January-July this year, the market structure remained stable, with the only change in ranking being Foton Cummins surpassing Jiangling Motors Corporation (JMC) to rise to sixth place. However, the overall change in the enterprises involved in the top ten and their combined market share was not significant. Among them, Weichai, Yunnei, Foton Cummins, SAIC Diesel Engine (Shangchai), and Dongfeng Commercial Vehicle saw cumulative sales increases of over 30%, with Yunnei's increase being approximately 51.6%.

A highlight is the competition between Yunnei Power and Yuchai Group for second place. Both have market shares between 10% and 11%, with a difference of only 0.31%. Who will be the final winner?

Multi-cylinder diesel engines for commercial vehicles: Yunnei's share approaches 12%, Foton Cummins and SAIC Diesel Engine (Shangchai) rankings rise

In August this year, sales of multi-cylinder diesel engines for commercial vehicles were 262,100 units, a month-on-month decrease of 9.43% and a year-on-year increase of 47.64%; cumulative sales from January to August reached 2.0705 million units, a year-on-year increase of 19.24%.

From January to August this year, the top ten enterprises in cumulative sales were Weichai, Yunnei Power, FAW Jiefang Power, Yuchai, Foton Cummins, Jiangling Motors Corporation (JMC), Dongfeng Cummins, Quanchai, SAIC Diesel Engine (Shangchai), and Dongfeng Commercial Vehicle. Compared to January-July, the top four positions remained stable. Foton Cummins surpassed Jiangling Motors Corporation (JMC) to move from sixth to fifth, and SAIC Diesel Engine (Shangchai) surpassed Dongfeng Commercial Vehicle to move from tenth to ninth. Foton Cummins engines are primarily used in Auman heavy-duty trucks, and SAIC Diesel Engine (Shangchai) engines are primarily used in SAIC Hongyan heavy-duty trucks. The rise in their diesel engine sales rankings is closely linked to the significant sales increases of Auman and Hongyan in the heavy-duty truck market. According to production and sales data released by the China Association of Automobile Manufacturers (CAAM), Foton and Hongyan lead the industry in cumulative sales growth in the tractor segment, with Foton's year-on-year increase at 99% and Hongyan's at 151%.

The sales of the top ten enterprises accounted for 88.57% of total sales. Weichai leads in the multi-cylinder diesel engine market share for commercial vehicles, accounting for 23.08%. Following are Yunnei Power at 11.93%, FAW Jiefang Power at 10.50%, Yuchai at 9.87%, Foton Cummins at 9.37%, Jiangling Motors Corporation (JMC) at 9.35%, Dongfeng Cummins at 4.52%, Quanchai at 4.46%, SAIC Diesel Engine (Shangchai) at 2.79%, and Dongfeng Commercial Vehicle at 2.69%. Compared to January-July, enterprises that saw an increase in market share include Yunnei Power, Foton Cummins, Jiangling Motors Corporation (JMC), Dongfeng Cummins, SAIC Diesel Engine (Shangchai), and Dongfeng Commercial Vehicle, with net increases of 0.28%, 0.12%, 0.16%, 0.01%, 0.2%, and 0.21% respectively; among them, Yunnei Power had the fastest share growth.

The 'shining' star—Yunnei Power, poised for further expansion in the future

Looking closely at the multi-cylinder diesel engine market for commercial vehicles from January to August this year, Yunnei Power, while perhaps not the brightest star, can certainly be considered the most 'shining' one—not only achieving significant year-on-year sales growth but also maintaining a continuously positive upward trend in its market share.

The editor noticed that during the same period last year (January-August), Yunnei Power's market share in the multi-cylinder diesel engine sector for commercial vehicles was less than 10%; however, since the beginning of this year, Yunnei Power's share has gradually increased, reaching 9.43% in January, 9.74% in February, 11.55% in March (ranking second), 11.76% in April, 11.51% in May, 11.65% in June, 11.65% in July, and now 11.93% in August. This represents a 2.5 percentage point increase compared to January and maintains its position as the industry's second-largest player. From less than 10% to exceeding 11%, and soon to surpass 12%, Yunnei Power's market growth rate reflects not only its strong risk response capabilities in the face of the epidemic and difficulties, but also the user's recognition of Yunnei Power's products and quality.

It is understood that Yunnei Power adheres to a market-oriented principle. While promoting the marketization of the Dewei series 2.0L-6.7L National VI engines, it has also made breakthroughs in gasoline engines and hybrid powertrains, resulting in a rich product portfolio and excellent performance indicators that can fully meet the needs of users in various fields. In addition, Yunnei Power's National VI diesel engines, National VI gasoline engines, National VI natural gas engines, hybrid powertrains, and fuel cell engines, etc., are upgraded in accordance with national emission regulations. Leveraging a national-level enterprise technology center, a new structure of "one department, five centers, and five major production bases" has been formed, providing strong technical support and production capacity construction guarantee systems for the products. Yunnei Power has many more significant plans in the works for the future.

Conclusion

After a slight slowdown in August, how will the continuously rising diesel engine market perform during the upcoming "Golden September" and "Silver October"? Will it experience rapid growth again due to the peak season in the commercial vehicle market?

Related Downloads

Previous page

Related Content